kansas vehicle sales tax rate

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. The Kansas Retailers Sales Tax was enacted in 1937 at the rate of 2 increasing over the years to the current state rate of 650.

Car Tax By State Usa Manual Car Sales Tax Calculator

Average Sales Tax With Local.

. The state sales tax rate in Kansas is 6500. The premium tax rate for domestic and foreign insurance companies doing business in Kansas. 775 for vehicle over 50000.

Or the jurisdiction name then click Lookup. And Statistical Reports Address Tax Rate Locator Web. The fee to transfer is 1250 plus the difference in the property tax.

Select the Kansas city from the list of popular cities below to see its current sales tax rate. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Our tax base ensures that no single industry is disproportionately burdened and tax credits and exemptions are helping to lower the cost of doing business in Kansas.

The sales tax in Sedgwick County is 75 percent. Your tax rate for the 2021 tax year is. Sales tax rates are subject to change periodically.

What follows is an explanation of the sales tax treatment. Accuracy cannot be guaranteed at all times. With local taxes the total sales tax rate is between 6500 and 10500.

This notice addresses changes to the Kansas sales and use tax rates. Code or the jurisdiction name then click Lookup Jurisdiction. The rate ranges from 75 and 106.

Burghart is a graduate of the University of Kansas. Contact your County Treasurer for an closer estimate of costs. Of other common elements of the sale of a new or used motor.

If you reside on Fort Riley your address will determine whether you register in Riley County or in Geary County. Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1979 on top of the state tax. Search for Vehicles by VIN -Or- Make Model Year -Or-.

The maximum local tax rate allowed by Kansas law is 4. DeSoto Leavenworth County DESLV. Average Local State Sales Tax.

We strongly recommend using a sales tax calculator to determine the exact sales tax amount for your location. You will need to take the vehicle and the title for the vehicle to a Kansas motor vehicle inspection station and obtain a Motor Vehicle Examination form MVE-1. Subject to sales tax.

These sales incentives. Does the sales tax amount differ from state to state. Effective July 1 2022 CITY CHANGES Jurisdiction Code.

Mulvane Sedgwick County MULSG. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Kansas has recent rate changes Thu Jul 01 2021.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. States with high tax rates tend to be above 10 of the price of the vehicle. 635 for vehicle 50k or less.

679 rows Kansas Sales Tax. When paying in person at the counter at either the Olathe or Mission location the credit card convenience fee is 26 of the total transaction amount with a 3 minimum subject to change. Car tax as listed.

What states have the highest sales tax on new cars. Local sales rates and changes. Kansas Department of Revenue.

The tax environment in Kansas is designed to be fair and favorable to your business. Car Sales Tax on Private Sales in Kansas. Municipal governments in Kansas are also allowed to collect a local-option sales tax that ranges from 0 to 5 across the state with an average local tax of 1987 for a total of 8487 when combined with the state sales tax.

425 Motor Vehicle Document Fee. The minimum sales tax varies from state to state. KS Combined State Local Sales Tax Rate avg 8046.

When paying in person at the kiosk at either the Olathe or Mission location the credit card convenience fee is 24 of the total transaction amount. Sales tax is 26500 385 75 950 27910. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

KS State Sales Tax Rate. Please contact either Treasurers office to determine where you will need to pay your. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Kansas has a statewide sales tax rate of 65 which has been in place since 1937. Destination-based sales tax information. Mulvane Sumner County MULSU.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. For instance if you purchase a vehicle from a private party for 27000 and you live in a county that charges 8 total sales tax then you will have to multiply the 27000 sales amount by 08 and get 2160. File withholding and sales tax online.

Maximum Possible Sales Tax. Kansas Vehicle Property Tax Check - Estimates Only. In-house rebates or dealer discounts are not subject to.

This publication will address whether sales or compensating use tax is due on a particular vehicle. The state sales tax applies for private car sales in Kansas. The sales tax rate varies by County.

BACK COVER 3 KANSAS SALES TAX This publication has been developed. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. 200 1937 400 1986 530 2002 650 2015.

If the dealers rate is lower than Geary County then there will be a sales tax difference that will need to be paid during the time of titling and registrationThe rate in Geary County is 975. There are also local taxes up to 1 which will vary depending on region. DeSoto Johnson County DESJO.

Car Sales Tax In Kansas Getjerry Com

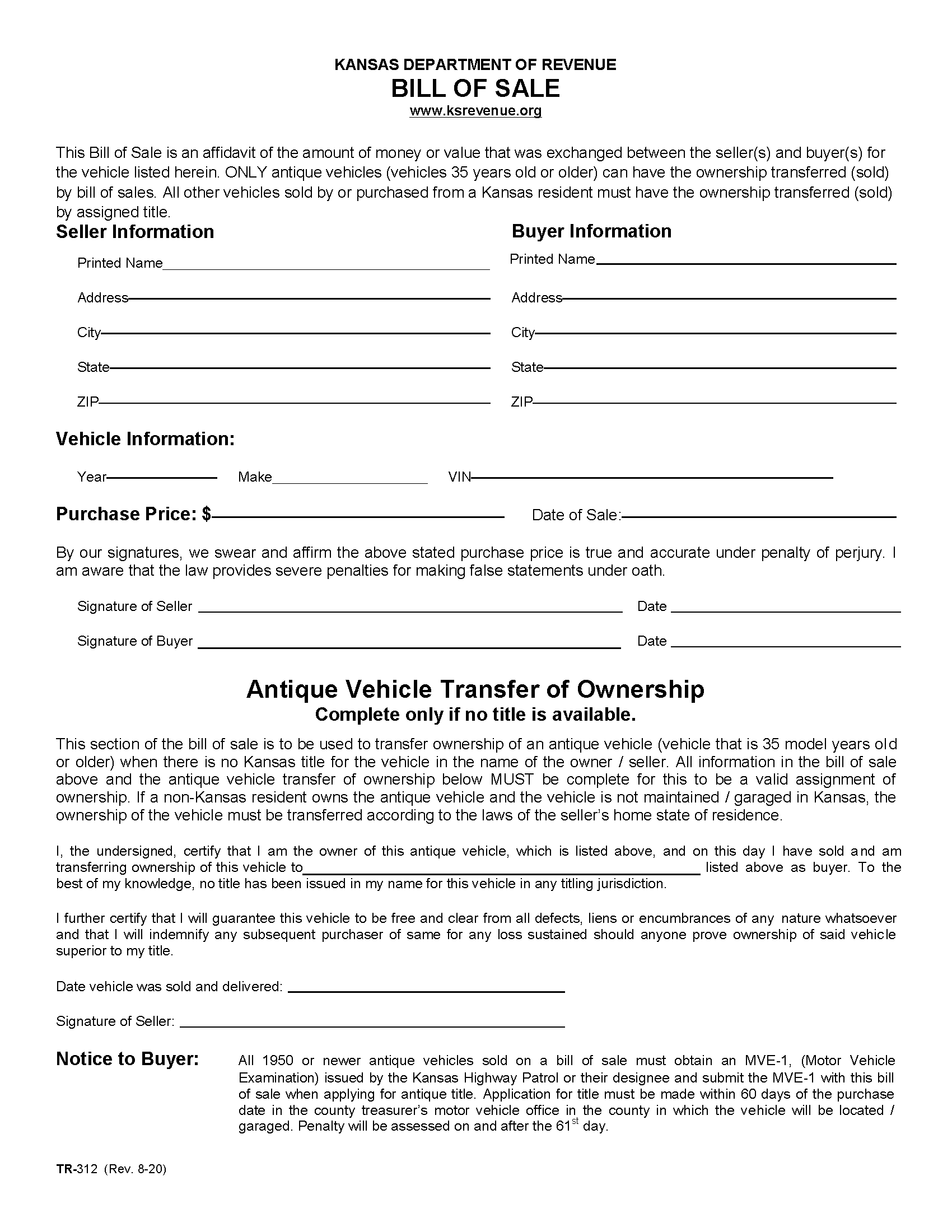

Free Kansas Motor Vehicle Bill Of Sale Form Pdf Word

Kansas Vehicle Sales Tax Fees Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax On Cars And Vehicles In Kansas

Car Sales Tax In Kansas Getjerry Com

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Missouri Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Missouri Car Sales Tax Calculator

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Motor Vehicle Fees And Payment Options Johnson County Kansas